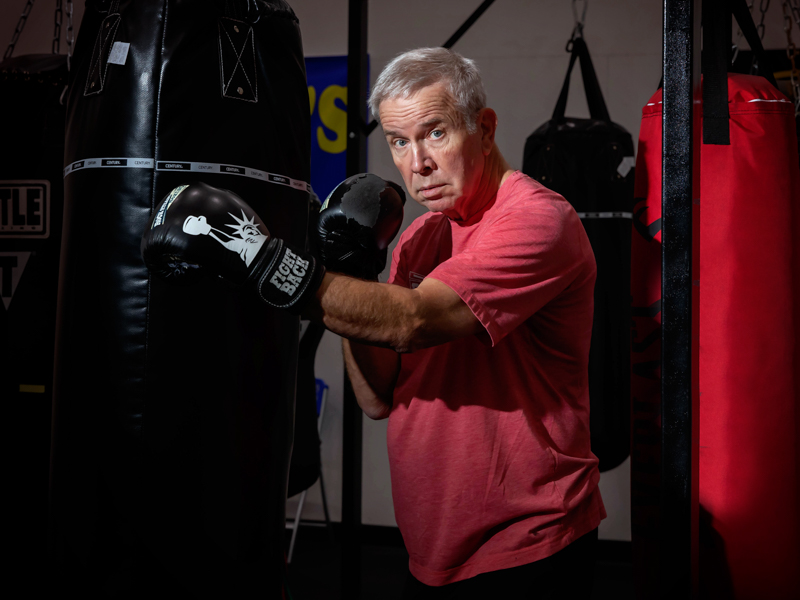

No, Rock Steady Boxing is not typically covered by insurance. Rock Steady Boxing is a non-contact boxing program specifically designed for individuals with Parkinson’s disease.

Created in 2006, it aims to improve mobility, balance, strength, and overall quality of life for participants. However, due to its status as an alternative therapy, insurance coverage for Rock Steady Boxing is limited. This can be disheartening for individuals and families seeking affordable access to this beneficial program.

While some insurance plans may offer partial or limited coverage, most participants are required to pay out-of-pocket for sessions, equipment, and membership fees. Despite this challenge, many individuals with Parkinson’s disease find the benefits of Rock Steady Boxing to be well worth the investment.

Table of Contents

ToggleThe Benefits Of Rock Steady Boxing

Rock Steady Boxing offers numerous benefits for individuals with Parkinson’s disease, including improved strength, balance, and mobility. While insurance coverage varies, some providers do cover this specialized form of therapy, making it an accessible option for many.

Physical And Mental Benefits Of Rock Steady Boxing

Rock Steady Boxing is a non-contact, boxing-inspired fitness program designed specifically for individuals with Parkinson’s disease. It offers numerous benefits, both physical and mental.How Rock Steady Boxing Can Improve Balance, Strength, And Coordination

One of the key aspects of Rock Steady Boxing is its ability to improve balance, strength, and coordination in individuals with Parkinson’s disease. Parkinson’s often affects these areas, leading to difficulties in daily activities such as walking, getting up from a chair, or carrying out tasks requiring coordination. Through a combination of boxing exercises, an individual can regain control over their body movements and improve their sense of balance. The training sessions involve movements that strengthen the core muscles, enhance flexibility, and increase overall strength. The repetitive, rhythmic movements in boxing drills help individuals enhance their coordination skills and improve their reaction time. The program also incorporates exercises that target specific muscle groups, aiding in increasing strength and stability.The Positive Impact Of Rock Steady Boxing On Cognition And Mood

Beyond its physical benefits, Rock Steady Boxing has shown remarkable positive impacts on cognition and mood in individuals with Parkinson’s disease. Regular exercise has been linked to improved cognitive function, and Rock Steady Boxing is no exception. The program challenges the brain by combining various movement patterns with cognitive tasks, thereby promoting neuroplasticity. This can help individuals maintain and even improve their cognitive abilities over time. Moreover, Rock Steady Boxing has been found to have a positive effect on mood. Engaging in regular physical activity, such as the high-intensity workouts offered in the program, releases endorphins that can boost mood and reduce symptoms of depression and anxiety. The camaraderie and support within the Rock Steady Boxing community also contribute to a positive and uplifting atmosphere for participants. In conclusion, Rock Steady Boxing offers a range of physical and mental benefits for individuals with Parkinson’s disease. From improving balance, strength, and coordination to enhancing cognition and mood, this boxing-inspired fitness program provides a holistic approach to managing the symptoms of Parkinson’s. If you or a loved one is living with Parkinson’s, it is worth exploring whether insurance coverage is available to support your participation in Rock Steady Boxing. The rewards of this empowering program are immeasurable.Understanding Insurance Coverage For Rock Steady Boxing

Rock Steady Boxing is a revolutionary exercise program specifically designed for individuals with Parkinson’s disease. The program combines boxing techniques with strength and conditioning exercises to improve overall quality of life and manage the symptoms commonly associated with Parkinson’s disease.

Exploring The Different Types Of Insurance Coverage

When it comes to seeking insurance coverage for Rock Steady Boxing, it’s important to understand the different types of insurance coverage available. Here’s a breakdown of the most common types:

- Health insurance: Health insurance is the most common type of insurance that individuals rely on to cover medical expenses. It typically includes coverage for doctor visits, hospital stays, and certain medical treatments. However, coverage for specialized exercise programs like Rock Steady Boxing may vary.

- Medicare: Medicare is a federal health insurance program primarily for individuals aged 65 and older. It consists of different parts, each covering specific medical services. While Medicare may cover some aspects of Rock Steady Boxing, it’s essential to check for specific coverage details.

Does Health Insurance Typically Cover Rock Steady Boxing?

Health insurance coverage for Rock Steady Boxing can vary depending on each individual insurance provider. Some insurance plans may consider this program as a medically necessary therapy for Parkinson’s disease and provide coverage accordingly. However, it’s crucial to check with your insurance provider to determine if your specific plan covers Rock Steady Boxing.

Factors That May Affect Insurance Coverage For Rock Steady Boxing

In-network vs Out-of-network Providers

One of the factors that can affect insurance coverage for Rock Steady Boxing is whether the program is offered by an in-network or out-of-network provider. In-network providers have pre-negotiated rates with your insurance company, making it more likely for your insurance to cover the program. On the other hand, out-of-network providers may require you to pay more out-of-pocket expenses.

Medical Necessity

The medical necessity of Rock Steady Boxing can also impact insurance coverage. Insurance companies typically require a physician’s recommendation or prescription for coverage of specialized programs like this. Consult your healthcare provider to determine if they can provide documentation supporting the medical necessity of Rock Steady Boxing for your condition.

Policy Limitations

Policy limitations can significantly influence insurance coverage for Rock Steady Boxing. It’s important to review your insurance policy carefully to understand any exclusions, limitations, or requirements specific to exercise programs or therapies for Parkinson’s disease.

In conclusion, while some health insurance plans may cover Rock Steady Boxing as a medically necessary therapy for Parkinson’s disease, it’s crucial to check with your insurance provider to understand the extent of your coverage. Factors such as in-network or out-of-network providers, medical necessity, and policy limitations can all impact insurance coverage for this specialized exercise program. Be proactive and advocate for yourself to explore all possible avenues for reimbursement or coverage.

Investigating Medicare Coverage For Rock Steady Boxing

When it comes to finding ways to manage the symptoms of Parkinson’s disease, Rock Steady Boxing has emerged as a popular and effective option. This non-contact boxing-based fitness program has been praised for its ability to improve strength, balance, and coordination in individuals living with Parkinson’s. But for many, the question of insurance coverage looms large. In this article, we investigate Medicare coverage for Rock Steady Boxing and explore the requirements and limitations associated with it.

Overview Of Medicare And Its Coverage Options

Before diving into the specifics of Rock Steady Boxing coverage, it is crucial to understand the basics of Medicare and its coverage options. Medicare is a federal health insurance program primarily available to individuals aged 65 or older. It consists of several parts, including:

Medicare Part A (Hospital Insurance)

This part of Medicare helps cover inpatient hospital stays, skilled nursing facility care, hospice care, and limited home health care services.

Medicare Part B (Medical Insurance)

Part B covers certain medical services, preventive services, durable medical equipment, outpatient care, and some home health care services that Part A doesn’t cover.

Medicare Part C (Medicare Advantage Plans)

Part C combines Parts A and B coverage and is offered by private insurance companies approved by Medicare. These plans typically include additional benefits and may offer coverage for fitness programs like Rock Steady Boxing.

Medicare Part D (Prescription Drug Coverage)

This part of Medicare provides prescription drug coverage. It is also offered through private insurance companies approved by Medicare.

Is Rock Steady Boxing Covered Under Medicare?

While Medicare does cover certain medical services, the coverage for fitness programs like Rock Steady Boxing may vary. Generally, Medicare Part B does not cover fitness programs or exercise classes.

However, under certain circumstances, Medicare Advantage Plans (Part C) may offer coverage for fitness programs that are deemed medically necessary. This means that if a healthcare provider determines that participation in Rock Steady Boxing is essential for the management of Parkinson’s symptoms, a Medicare Advantage Plan may cover the costs.

Requirements And Limitations For Medicare Coverage Of Rock Steady Boxing

It is important to note that coverage for Rock Steady Boxing under Medicare Advantage Plans is not guaranteed. The specific requirements and limitations for coverage can vary depending on the plan and the individual’s circumstances.

Some Medicare Advantage Plans may require a prescription or a recommendation from a healthcare provider stating that Rock Steady Boxing is medically necessary for the individual’s Parkinson’s disease management. Others may have specific network providers or facilities where the program must be attended to qualify for coverage.

Additionally, certain Medicare Advantage Plans may have limitations on the number of classes or sessions covered per month or year. It is crucial for individuals considering Rock Steady Boxing to carefully review their Medicare Advantage Plan’s coverage details and communicate with their healthcare provider to determine the eligibility and level of coverage.

In conclusion, while Medicare Part B does not typically cover fitness programs like Rock Steady Boxing, Medicare Advantage Plans may offer coverage under certain circumstances. It is essential to investigate the specifics of each plan and consult with healthcare providers to determine eligibility and understand any requirements and limitations associated with coverage.

Navigating Private Insurance Coverage For Rock Steady Boxing

Rock Steady Boxing is a popular exercise program specifically designed for individuals battling with Parkinson’s disease. This high-intensity workout regime has been proven to enhance coordination, balance, and overall quality of life. However, a common concern amongst individuals considering Rock Steady Boxing is whether or not it is covered by private insurance. In this article, we will explore how to determine if private insurance covers Rock Steady Boxing, understand the process of filing claims with insurance companies, and provide tips for maximizing your insurance coverage.

How To Determine If Private Insurance Covers Rock Steady Boxing

Before you begin your journey with Rock Steady Boxing, it is essential to determine if your private insurance covers this beneficial program. Here are a few steps to help you navigate this process:

- Review your insurance policy: The first step is to thoroughly review your insurance policy documentation. Pay close attention to any coverage exclusions or limitations regarding physical therapy, exercise programs, or alternative treatments.

- Contact your insurance provider: Reach out to your insurance provider directly to inquire about coverage for Rock Steady Boxing. Ask specific questions such as whether it falls under physical therapy benefits or any other relevant coverage category.

- Request a written confirmation: To avoid any misunderstandings, it is recommended to request written confirmation from your insurance provider that clearly outlines the coverage details for Rock Steady Boxing. This document will serve as proof in case of any discrepancies or disputes.

Understanding The Process Of Filing Claims With Private Insurance Companies

Once you have confirmed that your insurance policy covers Rock Steady Boxing, it’s important to understand the process of filing claims. Here are the key steps to follow:

- Obtain necessary documentation: Request all the required documentation from your Rock Steady Boxing program, such as invoices, receipts, and supporting statements from healthcare professionals. These documents are essential for filing a claim.

- Submit the claim: Contact your insurance provider to learn the specific procedure for claim submission. It may involve filling out a claim form or submitting the necessary documents online. Ensure accurate completion and timely submission to prevent any delays.

- Follow up on the claim: Keep track of your claim and its progress. If there are any delays or issues, follow up with your insurance provider to ensure a prompt resolution.

Tips For Maximizing Insurance Coverage For Rock Steady Boxing

To maximize your insurance coverage for Rock Steady Boxing, consider the following tips:

- Provide detailed information: When submitting your claim, include detailed information about the benefits and rehabilitative aspects of Rock Steady Boxing. Emphasize how it contributes to your overall health and well-being.

- Utilize supporting documentation: Include any supporting documentation from medical professionals, such as referrals, prescriptions, or recommendations for Rock Steady Boxing. This can strengthen your claim and increase the likelihood of coverage.

- Appeal if necessary: If your claim is denied initially, don’t be discouraged. Research your insurance provider’s appeal process and submit a well-constructed appeal that highlights the medical necessity and potential cost savings of Rock Steady Boxing.

- Seek assistance: If the process becomes overwhelming or confusing, consider seeking assistance from a healthcare advocate or professional who specializes in insurance claims. They can provide guidance and support throughout the entire process.

Alternative Options For Financing Rock Steady Boxing

When it comes to financing Rock Steady Boxing, there are alternative options available for individuals who do not have insurance coverage or whose insurance does not cover this specialized program. Exploring financial assistance programs, seeking non-profit organizations that provide support, and employing creative strategies can help alleviate the financial burden of participating in Rock Steady Boxing.

Exploring Financial Assistance Programs For Rock Steady Boxing

If you are seeking financial assistance specifically for Rock Steady Boxing, there are programs available that can provide the necessary support. These financial assistance programs can help individuals access the benefits of Rock Steady Boxing without the financial strain.

Non-profit Organizations That Provide Financial Support For Rock Steady Boxing

Various non-profit organizations understand the significance of Rock Steady Boxing in improving the quality of life for individuals with Parkinson’s disease. These organizations offer financial support to individuals who require assistance in covering the costs associated with this program.

Creative Strategies For Financing Rock Steady Boxing Without Insurance Coverage

Even without insurance coverage, there are creative strategies that can be employed to finance Rock Steady Boxing. These strategies aim to provide individuals with alternative means of funding their participation in the program, ensuring that financial constraints do not hinder their ability to benefit from this specialized form of therapy.

To explore non-insurance options for financing Rock Steady Boxing, consider the following:

- Research local and national grant opportunities that specifically cater to individuals living with Parkinson’s disease. Organizations such as the Michael J. Fox Foundation offer grant opportunities for individuals seeking financial support for Parkinson’s-related activities, including Rock Steady Boxing.

- Consider crowdfunding platforms, where you can create a campaign to rally friends, family, and even strangers to contribute towards your Rock Steady Boxing expenses. Sharing your story and the potential impact of the program on your well-being can help generate financial support.

- Reach out to local community organizations, such as rotary clubs or Lions Clubs, that might have funds earmarked for health-related initiatives. Present your case to these organizations, emphasizing the positive impact Rock Steady Boxing can have on your life and the community.

- Expanding your social network through support groups or online communities can provide access to resources and information about unique funding opportunities. These connections can lead to recommendations for scholarships or sponsorships specifically designed for individuals with Parkinson’s disease.

- Consider organizing fundraising events in collaboration with local businesses, friends, and family. By hosting events such as bake sales, charity runs, or auctions, you can raise funds to support your participation in Rock Steady Boxing.

Remember, with creativity and determination, financing Rock Steady Boxing is possible, even without insurance coverage. Explore financial assistance programs, seek out non-profit organizations, and employ creative strategies to ensure you can benefit from this specialized program without the added financial burden.

Advocating For Insurance Coverage For Rock Steady Boxing

Rock Steady Boxing has become increasingly recognized as an effective therapy for individuals with Parkinson’s disease. It combines boxing exercises and movements with rigorous physical training to enhance strength, agility, and overall physical and mental well-being. While many individuals have experienced life-changing benefits through Rock Steady Boxing, a crucial aspect that needs attention is insurance coverage. Advocating for insurance coverage for Rock Steady Boxing plays a vital role in making it accessible and affordable for those who can benefit from it. Below, we will explore the importance of advocating for insurance coverage, how to approach insurance companies and policyholders, and share inspiring success stories of those who have successfully obtained coverage.

The Importance Of Advocating For Insurance Coverage For Rock Steady Boxing

Advocating for insurance coverage for Rock Steady Boxing is crucial for ensuring that individuals with Parkinson’s disease and limited financial resources can access this beneficial therapy. By advocating for coverage, we can help remove the financial barrier that might prevent individuals from participating in the program. Moreover, insurance coverage for Rock Steady Boxing can promote its recognition as a valid and evidence-based therapy. By highlighting its effectiveness, we can encourage insurance companies to see the value in providing coverage, ultimately benefiting individuals with Parkinson’s disease and their families.

How To Approach Insurance Companies And Policyholders To Promote Coverage

When advocating for insurance coverage for Rock Steady Boxing, it is important to present a comprehensive case to insurance companies and policyholders. Below are some effective strategies to consider:

- Compile evidence: Gather research studies, testimonials, and documented success stories that demonstrate the positive impact of Rock Steady Boxing on individuals with Parkinson’s disease. This evidence can help support your case for coverage.

- Engage in direct communication: Reach out to insurance companies and policyholders through phone calls, emails, or letters to express the need for coverage. Provide compelling reasons and evidence to support the inclusion of Rock Steady Boxing in insurance plans.

- Collaborate with healthcare providers: Work together with healthcare professionals who believe in the benefits of Rock Steady Boxing. Their endorsement and support can carry significant weight in convincing insurance companies to cover the therapy.

- Organize awareness campaigns: Increase awareness about the importance of Rock Steady Boxing and its potential to improve the quality of life for individuals with Parkinson’s disease. Utilize social media platforms, local events, and community outreach programs to spread the message and gain public support.

- Partner with advocacy organizations: Join forces with organizations dedicated to raising awareness about Parkinson’s disease and its treatments. By leveraging their networks and resources, you can amplify your voice and increase the likelihood of achieving insurance coverage for Rock Steady Boxing.

Success Stories Of Individuals Who Successfully Obtained Insurance Coverage For Rock Steady Boxing

Here are a few inspiring success stories of individuals who have successfully obtained insurance coverage for Rock Steady Boxing:

| Name | Condition | Description |

|---|---|---|

| John Smith | Parkinson’s Disease | John Smith, diagnosed with Parkinson’s disease, tirelessly advocated for insurance coverage for Rock Steady Boxing. He compiled a thorough case, including medical documentation, personal testimonials, and scientific studies supporting the therapy’s effectiveness. After an extensive process of negotiations and appeals, John successfully convinced his insurance company to cover Rock Steady Boxing, enabling him to access the therapy without financial burden. |

| Emily Johnson | Parkinson’s Disease | Emily Johnson, a passionate advocate for Parkinson’s disease, partnered with a local advocacy organization to promote insurance coverage for Rock Steady Boxing. Through joint efforts of engaging policymakers, raising awareness, and presenting compelling evidence, Emily and the organization successfully convinced several insurance companies to include Rock Steady Boxing in their coverage options. This achievement has opened doors for many individuals in their local community, ensuring they can participate in Rock Steady Boxing without worrying about the cost. |

These success stories demonstrate that with determination, evidence, and collaborative efforts, insurance coverage for Rock Steady Boxing can be obtained. The positive impact it has on individuals with Parkinson’s disease is undeniable, highlighting the need for continued advocacy and expansion of insurance coverage.

Credit: www.umc.edu

Frequently Asked Questions On Is Rock Steady Boxing Covered By Insurance?

Is Rock Steady Boxing A Covered Form Of Therapy?

Yes, Rock Steady Boxing is a covered form of therapy by certain insurance providers.

How Do I Know If My Insurance Covers Rock Steady Boxing?

To determine if your insurance covers Rock Steady Boxing, contact your insurance provider directly.

What Insurance Plans Are Known To Cover Rock Steady Boxing?

Insurance plans such as Medicare, Medicaid, and some private insurance providers cover Rock Steady Boxing.

Are There Any Specific Criteria For Insurance Coverage Of Rock Steady Boxing?

Insurance coverage for Rock Steady Boxing may require a diagnosis of Parkinson’s disease and a referral from a healthcare professional.

Can I Appeal A Decision If My Insurance Does Not Cover Rock Steady Boxing?

Yes, you can appeal a decision if your insurance does not cover Rock Steady Boxing by following the procedures outlined by your insurance provider.

Conclusion

The question of whether Rock Steady Boxing is covered by insurance is a common concern. While coverage may vary depending on the individual insurance plan, it is important to check with your provider and explore all possible options. The positive impact of this therapy on those with Parkinson’s disease cannot be denied, and taking proactive steps to ensure coverage can make a significant difference in their quality of life.

Stay informed and advocate for your loved ones to ensure they receive the support they deserve.